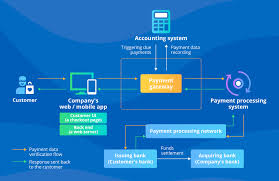

In today’s rapidly evolving digital landscape, e-commerce has become an integral part of conducting business. As online transactions continue to rise in popularity, ensuring the security and seamless integration of payment gateways within e-commerce platforms is of utmost importance. SuiteCommerce, a robust e-commerce solution developed by Oracle NetSuite, offers powerful integration capabilities with various payment gateways, enabling businesses to provide their customers with secure and convenient payment options. In this comprehensive blog post, we will delve into the significance of SuiteCommerce integration with payment gateways and discuss best practices for ensuring secure transactions.

The Importance of Secure Payment Processing

When it comes to online transactions, security is paramount. Customers entrust their sensitive financial information to e-commerce platforms, expecting their data to be protected from unauthorized access and fraudulent activities. Any breach in payment security can have severe consequences, including financial losses, reputational damage, and a loss of customer trust. Therefore, e-commerce businesses must prioritize the implementation of secure payment processing mechanisms to safeguard their customers’ data and maintain a strong reputation in the market.

SuiteCommerce understands the critical nature of payment security and has been designed with this in mind. By integrating with reliable and compliant payment gateways, SuiteCommerce enables businesses to offer secure transaction options to their customers. These payment gateways adhere to stringent security standards, such as the Payment Card Industry Data Security Standard (PCI DSS), ensuring that customer payment data is encrypted, transmitted securely, and stored in a protected environment.

Benefits of SuiteCommerce Payment Gateway Integration

Integrating SuiteCommerce with payment gateways offers several key benefits for businesses, enhancing the overall security and user experience of their e-commerce platform.

1.Enhanced Security Measures

Payment gateways employ advanced encryption technologies and follow industry-standard security protocols to safeguard sensitive customer data. By integrating SuiteCommerce with reputable payment gateways, businesses can ensure that their customers’ payment information remains secure throughout the entire transaction process. These gateways utilize robust encryption algorithms to protect data during transmission and storage, minimizing the risk of unauthorized access or data breaches.

Furthermore, payment gateways implement multi-layered security measures, such as tokenization and secure vault storage, to protect customer payment details. Tokenization replaces sensitive payment data with a unique, randomly generated token, which can be safely stored and used for subsequent transactions without exposing the actual payment information. This approach significantly reduces the risk of data breaches and helps businesses maintain a high level of security.

2.Seamless Checkout Experience

SuiteCommerce’s integration with payment gateways enables a seamless checkout process for customers. Instead of being redirected to external payment pages, customers can complete their transactions within the SuiteCommerce platform itself. This streamlined approach enhances the overall user experience, reducing the likelihood of cart abandonment and increasing conversion rates. A smooth and uninterrupted checkout process instills confidence in customers, encouraging them to complete their purchases without hesitation.

Moreover, payment gateway integration allows for the implementation of one-click payments and saved payment methods. Customers can securely store their payment information, enabling them to make future purchases with ease. This convenience not only improves the user experience but also fosters customer loyalty, as customers are more likely to return to a platform that offers a hassle-free and efficient checkout process.

3.Multiple Payment Options

Payment gateway integration allows businesses to offer a wide range of payment options to their customers. From credit and debit cards to digital wallets and alternative payment methods, customers can choose their preferred payment method, increasing convenience and catering to diverse preferences. By providing multiple payment options, businesses can reach a broader customer base and accommodate various payment preferences, ultimately driving higher sales and customer satisfaction.

In addition to traditional payment methods, SuiteCommerce integration with payment gateways enables businesses to accept payments through popular digital wallets such as PayPal, Apple Pay, and Google Pay. These digital payment solutions offer enhanced security features and a streamlined checkout experience, making it easier for customers to complete their purchases. By embracing a variety of payment options, businesses can tap into the growing trend of digital payments and meet the evolving expectations of their customers.

4.Advanced Fraud Prevention

Payment gateways incorporate sophisticated fraud detection and prevention mechanisms to protect businesses and customers from fraudulent activities. By leveraging advanced algorithms and real-time risk assessment, payment gateways can identify and block suspicious transactions, minimizing the risk of fraudulent charges and chargebacks. These gateways employ techniques such as velocity checks, IP address monitoring, and device fingerprinting to detect and prevent fraud, providing an additional layer of security for e-commerce transactions.

Furthermore, payment gateways offer customizable fraud rules and filters, allowing businesses to tailor their fraud prevention strategies based on their specific risk profiles and industry requirements. These rules can be configured to monitor transaction patterns, detect anomalies, and trigger alerts for suspicious activities. By proactively identifying and mitigating potential fraud, businesses can safeguard their revenue, reduce chargebacks, and maintain a positive reputation among customers.

5.Compliance and Regulatory Adherence

Payment gateways ensure compliance with various industry regulations and standards, such as PCI DSS, General Data Protection Regulation (GDPR), and local payment regulations. By integrating with compliant payment gateways, SuiteCommerce helps businesses meet their regulatory obligations and avoid potential penalties or legal consequences. Compliance with these standards demonstrates a commitment to data security and builds trust with customers, as they can be assured that their sensitive information is being handled in accordance with industry best practices.

Moreover, payment gateways assist businesses in navigating the complex landscape of international payments and cross-border transactions. They provide support for multiple currencies, local payment methods, and region-specific regulations, enabling businesses to expand their reach and serve customers globally. By partnering with a payment gateway that has a strong global presence and expertise in international payments, businesses can streamline their payment processes and ensure compliance with local requirements.

Selecting the Right Payment Gateway for SuiteCommerce

When choosing a payment gateway for SuiteCommerce integration, businesses should consider several key factors to ensure the best fit for their specific requirements and target audience.

1. Security and Compliance

The foremost consideration should be the payment gateway’s adherence to industry security standards, such as PCI DSS. Look for gateways that employ robust encryption technologies and regularly undergo security audits and certifications by recognized organizations. This ensures that the gateway takes data security seriously and implements the necessary measures to protect customer information from potential breaches or unauthorized access.

Additionally, evaluate the payment gateway’s compliance with other relevant regulations, such as GDPR, CCPA, and local payment laws. A compliant payment gateway will have the necessary safeguards in place to protect customer data privacy and ensure that businesses meet their legal obligations. Partnering with a compliant gateway reduces the risk of legal liabilities and demonstrates a commitment to data protection.

2.Supported Payment Methods

Evaluate the payment methods supported by the gateway and ensure they align with the preferences of your target audience. Consider the most commonly used payment options in your market, such as credit cards, debit cards, digital wallets, and alternative payment methods. Choosing a gateway that supports a wide range of payment options increases flexibility and accommodates diverse customer preferences, ultimately leading to higher conversion rates and customer satisfaction.

Furthermore, assess the gateway’s support for emerging payment technologies, such as contactless payments, mobile payments, and recurring billing. As customer payment preferences evolve, having a gateway that stays ahead of the curve and offers cutting-edge payment solutions can give businesses a competitive edge. It enables them to adapt to changing customer demands and provide a seamless payment experience across various channels.

3.Fraud Prevention Features

Assess the fraud prevention capabilities of the payment gateway to ensure your business is protected against fraudulent transactions. Look for features such as real-time fraud screening, risk scoring, velocity checks, and address verification services (AVS). These tools help identify and prevent suspicious activities, reducing the risk of chargebacks and financial losses. A gateway with advanced fraud prevention mechanisms provides an additional layer of security, safeguarding your business and customers from potential fraudulent activities.

Moreover, consider the payment gateway’s ability to provide customizable fraud rules and settings. Having the flexibility to adjust fraud parameters based on your business’s unique risk profile allows for more targeted and effective fraud prevention strategies. It enables businesses to strike a balance between security and customer experience, minimizing false positives and ensuring legitimate transactions are not unnecessarily flagged or declined.

4.Integration Ease and Technical Support

Consider the ease of integration between SuiteCommerce and the payment gateway. Look for gateways that offer well-documented APIs, software development kits (SDKs), and comprehensive integration guides. These resources streamline the implementation process and reduce the time and effort required for integration. A gateway with a user-friendly integration process and clear documentation ensures a smooth and efficient setup, allowing businesses to quickly start accepting payments through SuiteCommerce.

Additionally, evaluate the level of technical support provided by the payment gateway. Having access to knowledgeable support teams who can assist with integration challenges, troubleshooting, and ongoing maintenance is crucial. Look for gateways that offer dedicated support channels, such as phone, email, and live chat, with prompt response times. Reliable technical support ensures that any issues are resolved quickly, minimizing potential disruptions to your payment processing.

5.Pricing and Fee Structure

Compare the pricing structures and fees associated with different payment gateways to ensure they align with your business model and budget. Consider factors such as transaction fees, setup costs, monthly fees, and any additional charges for specific features or services. Assess the overall cost-effectiveness of the gateway, taking into account the potential benefits it brings to your business, such as increased security, improved customer experience, and higher conversion rates.

Additionally, evaluate the gateway’s pricing transparency and flexibility. Look for gateways that provide clear and straightforward pricing information, without hidden fees or complex pricing tiers. Consider whether the gateway offers customizable pricing plans or volume-based discounts, which can be beneficial for businesses with high transaction volumes. Choosing a gateway with a transparent and competitive pricing structure helps businesses optimize their payment processing costs and maintain profitability.

6.Global Coverage and Currency Support

If your business operates internationally, it is crucial to choose a payment gateway that supports multiple currencies and has a global presence. Consider the gateway’s ability to handle cross-border transactions, currency conversions, and local payment methods in your target markets. A gateway with extensive global coverage enables you to expand your business reach and cater to customers from different regions, providing them with a seamless and localized payment experience.

Moreover, assess the payment gateway’s support for dynamic currency conversion (DCC) and multi-currency pricing. DCC allows customers to view prices and pay in their preferred currency, while multi-currency pricing enables businesses to display prices in multiple currencies based on the customer’s location. These features enhance the customer experience, increase transparency, and reduce cart abandonment rates, especially for international transactions.

7.Reputation and Reliability

Research the reputation and reliability of the payment gateway provider to ensure you are partnering with a trusted and established entity. Look for user reviews, case studies, and testimonials from businesses similar to yours to gauge the gateway’s performance and customer satisfaction. Consider factors such as the gateway’s uptime, transaction processing speed, and responsiveness of customer support. A reliable and reputable payment gateway provider instills confidence in your customers and ensures a smooth and uninterrupted payment experience.

Additionally, assess the payment gateway’s track record in terms of security incidents and data breaches. Look for gateways that have a proven history of maintaining high security standards and promptly addressing any vulnerabilities or security concerns. Partnering with a gateway that prioritizes security and has a strong reputation in the industry helps mitigate risks and protects your business and customers from potential threats.

Implementing Secure Payment Integration with SuiteCommerce

Once you have selected a suitable payment gateway, follow these best practices to ensure secure payment integration with SuiteCommerce:

1.Utilize Secure Communication Protocols

Ensure that all communication between SuiteCommerce and the payment gateway occurs over secure protocols, such as HTTPS with SSL/TLS encryption. This protects sensitive data from interception and unauthorized access during transmission. Implementing secure communication protocols is essential to maintain the confidentiality and integrity of customer payment information.

2.Implement Tokenization

Utilize payment tokenization to replace sensitive payment data with a unique, randomized token. This token can be safely stored and used for subsequent transactions without exposing the actual payment information. Tokenization adds an extra layer of security and reduces the scope of PCI DSS compliance, as the actual payment data is not stored within your e-commerce platform.

3.Enable 3D Secure Authentication

Implement 3D Secure authentication for credit card transactions to provide an additional level of security. This authentication method requires customers to complete an additional verification step with their card issuer, reducing the risk of fraudulent transactions. Enabling 3D Secure shifts the liability for fraudulent chargebacks from the merchant to the card issuer, providing added protection for your business.

4.Regularly Update and Patch

Keep your SuiteCommerce platform and payment gateway integration up to date with the latest security patches and updates. Regularly monitor for any vulnerabilities or security advisories related to the payment gateway and address them promptly. Staying current with security updates ensures that your e-commerce platform remains protected against known vulnerabilities and emerging threats.

5.Implement Strong Access Controls

Enforce strong access controls and authentication mechanisms for accessing the SuiteCommerce administration panel and payment gateway settings. Implement multi-factor authentication, role-based access control, and secure password policies to prevent unauthorized access. Regularly review and update access privileges, ensuring that only authorized personnel have access to sensitive payment-related functions.

6.Educate and Train Your Team

Provide comprehensive training and awareness programs to your team members involved in handling payment data. Educate them about secure coding practices, data handling procedures, and the importance of maintaining the confidentiality and integrity of customer payment information. Regular training sessions reinforce security best practices and help foster a culture of security awareness within your organization.

7.Conduct Regular Security Audits

Perform regular security audits and penetration testing to identify and address any vulnerabilities in your SuiteCommerce platform and payment gateway integration. Engage with experienced security experts to assess the robustness of your payment processing infrastructure and implement necessary improvements. Regular audits help proactively identify and mitigate potential security risks before they can be exploited by malicious actors.

8.Develop a Comprehensive Incident Response Plan

Establish a comprehensive incident response plan to handle any potential security breaches or payment-related incidents effectively. Define clear protocols for detecting, reporting, and mitigating security incidents, and regularly test and update your incident response procedures. A well-defined incident response plan minimizes the impact of security breaches and ensures a swift and coordinated response to protect your business and customers.

Enhancing Customer Trust and Confidence

In addition to implementing secure payment processing measures, businesses can take additional steps to enhance customer trust and confidence in their e-commerce platform.

1.Display Security Badges and Trust Seals

Prominently display security badges and trust seals on your SuiteCommerce website, such as SSL certificates, PCI DSS compliance badges, and payment gateway logos. These visual cues reassure customers that their payment information is protected and handled securely. By showcasing your commitment to security, you build trust and credibility with your customers.

2.Provide Clear Security Information

Dedicate a section of your website to explain your security measures and payment processing practices. Clearly communicate how customer data is protected, encrypted, and stored, and highlight the compliance standards and certifications your business adheres to. Transparency about your security practices instills confidence in customers and demonstrates your commitment to safeguarding their sensitive information.

3.Offer Responsive Customer Support

Provide easily accessible customer support channels, such as live chat, phone support, or email, to address any payment-related concerns or inquiries promptly. Responsive and helpful customer support builds trust and confidence in your brand. Ensure that your support team is well-trained in handling payment-related issues and can provide accurate and timely assistance to customers.

4.Implement Clear Privacy Policies

Develop and prominently display your privacy policy, outlining how customer data is collected, used, and protected. Ensure that your privacy policy complies with relevant regulations, such as GDPR or CCPA, and communicate any updates to your customers in a timely manner. A clear and transparent privacy policy demonstrates your commitment to data protection and helps build trust with your customers.

5.Regularly Monitor and Audit

Continuously monitor your SuiteCommerce platform and payment gateway integration for any suspicious activities or anomalies. Implement real-time monitoring and alerting mechanisms to detect and respond to potential security incidents promptly. Conduct regular audits to identify and address any vulnerabilities or weaknesses in your payment processing infrastructure, ensuring the ongoing security and integrity of your e-commerce platform.

6.Foster a Security-Focused Culture

Promote a culture of security awareness within your organization. Regularly train and educate your employees about the importance of data security, best practices for handling sensitive information, and the potential consequences of security breaches. Encourage a proactive approach to security, where every team member understands their role in protecting customer data and maintaining the integrity of your e-commerce platform.

Conclusion

SuiteCommerce integration with payment gateways is crucial for ensuring secure and seamless online transactions. By leveraging the robust security features and compliance standards of payment gateways, businesses can protect their customers’ sensitive payment data and build trust in their e-commerce platform. Selecting the right payment gateway, implementing secure integration practices, and staying vigilant against evolving security threats are essential for maintaining a secure payment processing environment.

As the e-commerce landscape continues to evolve, staying abreast of the latest payment security technologies and best practices is imperative. By prioritizing payment security and integrating SuiteCommerce with trusted payment gateways, businesses can provide their customers with a safe and convenient online shopping experience, foster long-term customer loyalty, and drive sustainable growth in the digital marketplace.

Investing in secure payment processing not only safeguards your business from financial losses and reputational damage but also demonstrates your commitment to customer trust and satisfaction. By implementing the best practices outlined in this blog post and continuously monitoring and improving your payment security measures, you can establish a strong foundation for secure transactions and position your business for long-term success in the competitive e-commerce landscape.

Get in Touch

We know what NetSuite can do and how it can help you. Schedule your free NetSuite assessment today

FAQs:

SuiteCommerce is an e-commerce solution developed by Oracle NetSuite that supports seamless integration with various payment gateways. This integration enables businesses to offer secure and efficient payment options for their customers, allowing them to make purchases directly on the SuiteCommerce platform without redirection to external pages.

Secure payment processing is essential because it protects customers’ sensitive financial information, reducing the risk of data breaches, fraud, and financial losses. A breach can lead to severe reputational damage, financial liabilities, and loss of customer trust, making robust payment security critical for any online business.

Integrating SuiteCommerce with a payment gateway enhances security, improves the checkout experience, supports multiple payment methods, prevents fraud, and ensures compliance with industry standards like PCI DSS. This integration also helps businesses streamline the payment process and increase customer satisfaction and retention.

Payment gateways use advanced encryption, tokenization, and multi-layered security protocols to protect sensitive data. Features like secure vault storage, 3D Secure authentication, and real-time fraud detection further reduce the risk of unauthorized access and fraudulent transactions.

Tokenization replaces sensitive payment information, such as credit card numbers, with a unique, randomly generated token. This token can be stored and reused for future transactions without revealing actual payment details, which helps reduce the risk of data exposure if unauthorized access occurs.

Key considerations include security and compliance standards, supported payment methods, fraud prevention capabilities, ease of integration, pricing, and the gateway’s reputation and global reach. A suitable payment gateway should align with the business’s target market and provide a seamless and secure payment experience.

SuiteCommerce integrates with payment gateways that offer global coverage, support for multiple currencies, and compliance with regional regulations. This feature allows businesses to accept payments from various regions, provide localized payment options, and facilitate cross-border transactions.

PCI DSS (Payment Card Industry Data Security Standard) is a set of security standards designed to protect cardholder information. Compliance with PCI DSS ensures that businesses follow best practices in data protection, which is crucial for reducing the risk of data breaches and maintaining customer trust in online transactions.

3D Secure is an additional layer of security for online card payments. It requires cardholders to complete an extra verification step with their card issuer, reducing the risk of unauthorized transactions. For businesses, this helps to reduce fraud and chargebacks, as liability for fraudulent transactions shifts to the card issuer.

To maintain secure transactions, businesses should use secure communication protocols (e.g., HTTPS), enable tokenization, implement 3D Secure, regularly update and patch software, apply strong access controls, train staff on security practices, conduct regular security audits, and develop a robust incident response plan to address potential security issues promptly.